Autumn Budget 2024 – Full Summary

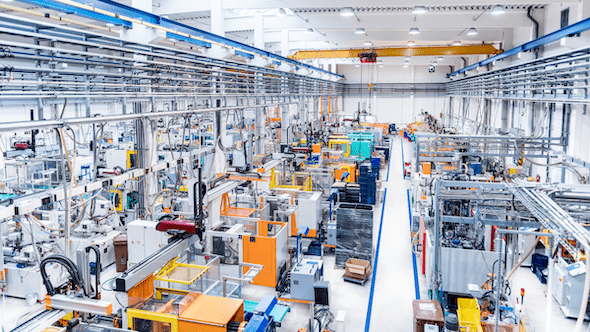

Chancellor Rachel Reeves delivered her Budget on 30 October 2024. She pledged to ‘invest, invest, invest’ to drive growth and ‘restore economic stability’.

Chancellor Rachel Reeves delivered her Budget on 30 October 2024. She pledged to ‘invest, invest, invest’ to drive growth and ‘restore economic stability’.

On 22 November 2023, Jeremy Hunt delivered the ‘Autumn Statement for Growth’. Against an improving economic backdrop, the Chancellor is keen to stimulate economic growth and highlighted 110 measures for businesses.

Ambitious entrepreneurs who want to attract investors can use two different schemes to provide the investor with income tax relief on the value subscribed for shares and capital gains tax relief on the disposal of those shares.

Owners and directors of family businesses often take a small salary from the company and any extra funds as dividends.

The new Chancellor Kwasi Kwarteng has decided to keep the main rate of corporation tax at 19% at all profit levels.

Many self-employed people will find January 2023 a tough month as it is predicted that domestic fuel bills will increase again and income tax payments will be due.